Fee disclosure for the plan sponsor…fee disclosure for plan participants: This has been a primary topic within the retirement industry among practitioners, sponsors, and participants for the last several years. While the additional transparency serves a purpose now and in the future, most of the discussions seem to stop short of the next industry hurdle. That is, how do plan sponsors not only ensure that fees in total are in check, but also how do plan sponsors ensure that the actual fees paid by each participant are fair and reasonable when compared to other participants within the plan?

Brief review: Fees collected from the expense ratios of investments to pay for a plan’s administration, custody, trustee, communication, investment advisory, compliance, and other required services are referred to in general as revenue sharing. However, revenue sharing represents only a portion of an investment option’s expense ratio, with the remainder being the cost of investment managers and services needed to manage the fund itself. After analyzing a portion of our clients investment options, the revenue sharing portion of an investment expense ratio typically ranges from zero to .50%. We have run across situations, often times during a bidding process, and learned that other investments at different providers sometimes even have higher revenue sharing percentages. (For example, the total expense ratio of an investment might be 0.75%, but only 0.25% is considered revenue sharing. Therefore, one-third of the total expense ratio is set aside to cover non-investment management expenses like administration, compliance, investment advisory, communication, and so forth.)

What is fair?

As a fiduciary, the first question each plan sponsor and/or retirement committee has to ask when it comes to fees being assessed at the participant level is, “What is fair?” Excluding the investment management portion of the expense ratio, is it fair that each participant pay the same percentage of their account balances, a fixed dollar amount each month/quarter, or a combination based on both balances and fixed rates?

Many plan sponsors and retirement committees probably haven’t had these discussions—often times because they don’t know that they have a choice. Sponsors sometimes assume that they are locked into assessing fees based on what their recordkeeper quoted and can administer, and/or on how fees are collected via the investments. However, they do have a choice and should analyze what is right for their retirement plan(s) and participants.

What’s not fair?

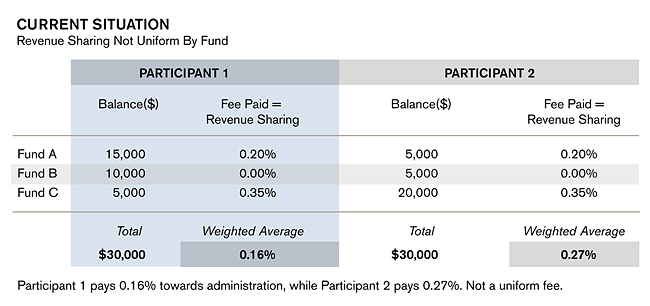

When it comes to plan fees, there is one prevalent current practice that creates an unfair (or inequitable, if you prefer) situation for participants. Fees collected via the investments (revenue sharing), which are not normalized at the fund level, are a major source of inequitable fee allocations at the participant level. Since the revenue sharing varies by fund and since participant investment allocations differ, revenue sharing collected as a fee is not a uniform percentage across participant balances nor is it a fixed dollar amount per participant account. These variations create inequitable fee allocations as illustrated in Figure 1 below, whereby the fees paid by each participant are not uniform. Plan sponsors need to understand that several fee collection methods exist in the industry today, which can create inequitable fees at the participant level. While the details of fee collection methods vary, the end result is the same as shown below.

The example in Figure 1 shows two participants, both using the same funds and both with the same total balance; yet because the revenue sharing collected from the investments varies by fund, they each pay different amounts for the plan services. In fact, Participant 2 pays 68% more in fees (via the revenue sharing) than Participant 1.

Figure 1: Revenue Sharing Creates Inequalities in Fees Paid Across Participants

These inequitable fee allocations are everywhere, often unchecked or noticed. Imagine a plan with index funds, self-directed brokerage accounts, and company stock in a fund lineup compared with funds that contain revenue sharing (usually index funds, brokerage accounts, and stock do not have any revenue sharing component—they pay zero towards fees). In the example in Figure 1, the difference is eleven basis points, but if Participant 1 placed their entire balance in Fund B, with zero revenue sharing, then Participant 1 would be paying zero towards plan fees while Participant 2 would be paying 27 basis points. When looking across multiple participants in a plan that has a range of revenue sharing percentages across the fund line-up, the differences in fees paid by participants can often span a 20-, 30-, or even a 40 basis point differential. This leads to huge inequitable fee amounts paid by the participants, especially over time.

Why do inequitable fee allocations exist?

Inequitable fees exist because this is how the market has evolved over the years, for numerous reasons, including simplifying the “How much does it cost?” question from sponsors and participants. Simple sells! So providers began bundling all of the services required to run a retirement plan and attached an easy, hands-off fee structure that was least disruptive to sponsors and participants, at least on the surface.

As with most things, the devil is in the details. This inequitable model/process has taken over the marketplace in the last 10 to 20 years and most sponsors, participants, and even practitioners didn’t evaluate the impact at the participant level. Sometimes when they did evaluate the participant level fees they justified the variations with arguments such as, “since most of the funds have revenue sharing, the variations are not significant.” So it went unchallenged for a number of years and only in the last couple of years has there been an increased awareness of this issue. There are still a large number of plan sponsors who don’t know the whole story and simply don’t realize the inequitable structure of the fees paid by their participants.

Inequity exists because it’s easy!

The existing models, which simply use the revenue sharing from the funds to pay for most—if not all—of the administration and other services, provide an easy option on a number of levels.

- It is easy for plan sponsors to understand: There are no invoices to review, typically no price increases as long as assets continue to grow, and no outside explicit (visible) fees to allocate to participants—all making it easy for plan sponsors to overlook (a familiar byproduct of the infamous "if it ain’t broke, don’t fix it" school of thought).

- For participants, it’s easy in part because the new participant fee regulations did not mandate that the revenue sharing portion of the expense ratio be disclosed so participants (and frankly sponsors also) could easily tell how much of their investment fees are being collected and used for services outside the fund management itself. It is easy, since the fees are implicit, embedded in the expense ratios, such that most participants really don’t understand how much they are truly paying for non-investment services.

Just because it’s easy doesn’t make it right. If we know that the individual fee allocations are not equitable, why isn’t everyone trying to solve this issue? Ultimately, the market will drive solutions (we are starting to see some now) but, in the meantime, many providers and sponsors are sticking with the old model. Why? Because the old model is easy and part of an established structure, it’s off the participant and sponsor radar, and solutions for fixing the fee inequities are more complex to administer and communicate to participants. Nevertheless, there are ways plan sponsors and practitioners in the industry can fix the inequitable allocation of fees. Sponsors and practitioners alike need to do right by the participants even if the ultimate solution is not as easy or completely understood by all participants.

Before we move on, I want to make one point. The current practice discussed above is an allowable option for assessing or offsetting appropriate fees from qualified plans. There is no clear guidance from the DOL or IRS which would mandate that sponsors have to “level or normalize” fees paid via revenue sharing such that all participants pay a uniform rate.

Solutions for keeping fees at the participant and fund levels fair

There are solutions to this issue which have been embraced by some plan sponsors and engineered by independent advisers and recordkeepers. The solutions include:

- Using all institutional funds (no revenue sharing). Due to fund investment minimums, usually only plans with larger asset bases can use this option.

- When revenue sharing is utilized (some good funds worth having in a plan may still only have a revenue sharing class), it is allocated back to the participants invested in that fund.

- Net the revenue sharing with a fixed fee on a fund-by-fund basis. (If the revenue sharing collected exceeds the fixed fee, then the excess is allocated to participants invested in that fund.)

Because of the disparity of revenue sharing, the solutions to normalize the fees across all participants and investments are described as “more complicated” and “harder to communicate to employees.” This is true, but as previously stated, just because it’s easy doesn’t make it right, which also means that just because it’s more complicated doesn’t make it wrong. I would speculate that once sponsors learn the facts, many would agree that the current revenue sharing models are not fair to all participants and some type of transition or solution is required.

However, there still will be a segment of the population (sponsors, providers, and participants) who think these new solutions are overly complex and, therefore, justify the current method as the most acceptable. I have seen that when this inequality is resolved, the total cost of the program is typically reduced (via lower expense ratio investments), thereby benefiting both the participants and the sponsor. For sponsors, the added transparency provides them with details about their underlying fees and services, which aids them in a fiduciary capacity. Given the recent court cases (i.e., the Schlichter cases involving prominent companies such as Cigna, Caterpillar, General Dynamics, and others), fiduciaries need to have a handle on revenue sharing within their plans as failure to monitor and adjust can have costly implications.

Back to the “what’s fair” question

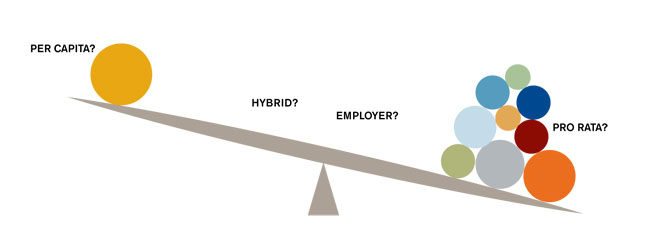

For discussion, let’s assume that the inequitable fees issue resulting from revenue sharing has been solved—pretend any revenue sharing is allocated back to the fund it came from as an expense reimbursement to the participant (see the second solution above). That still leaves us with the conundrum illustrated in Figure 2. If the plan sponsor wants to have the recordkeeping, investment advisor, compliance, communication, audit, and other acceptable fees paid from the plan, how should these fees be allocated to participants? Pro rata as an equal percentage of each participant’s balance, per capita as a fixed dollar amount per participant, or a combination of the two? Again, what is fair?

Figure 2: The Fee Balancing Act

As mentioned previously, plan sponsors and retirement committees often times haven’t engaged in discussions about how the fees should be allocated, not knowing they have a choice. The guidance from the U.S. Department of Labor (DOL) is fairly broad when it comes to fee allocations. Per DOL Field Assistance Bulletin (FAB) 2003-3, fees can be allocated to participants pro rata across individual participant balances, per capita level amount per participant, or a combination of the two methods. Below is an excerpt from the DOL FAB 2003-03, which provides the guidelines fiduciaries must work within when determining the fee allocation method:

When the plan documents are silent or ambiguous on this issue, fiduciaries must select the method or methods for allocating plan expenses. A plan fiduciary must be prudent in the selection of the method of allocation. Prudence in such instances would, at a minimum, require a process by which the fiduciary weighs the competing interests of various classes of the plan’s participants and the effects of various allocation methods on those interests. In addition to a deliberative process, a fiduciary’s decision must satisfy the “solely in the interest of participants” standard. In this regard, a method of allocating expenses would not fail to be “solely in the interest of participants” merely because the selected method disfavors one class of participants, provided that a rational basis exists for the selected method.

I have been involved in a number of committee discussions about this topic, out of which the following comments emerge over and over again (note the similarity of these comments also as compared to our national tax policy debates):

- “Pro rata method means the higher-account-balance participants will pay a disproportionate share of the total fees (based on dollars paid).”

- “Per-capita method has a larger impact on the smaller account balances.”

- “If both methods are applied, where do you draw the line? HR tends to be the advocate for the smaller-account-balance participants (favoring methods skewed towards pro rata), while Finance tends to favor methods skewed towards per capita methods."

The fact is there is no one-size-fits-all solution. Each plan sponsor needs to evaluate plan demographics and make a decision they feel is fair across all of their employee classes. But the first step is educating plan sponsors and retirement committees about the fact that they do have a choice when it comes to fee allocations and they don’t have to operate based on the current status quo.

Changing the norm: What’s down the road?

An inherent characteristic within the retirement industry is that, for the most part, pricing of multiple services within retirement plans has been largely tied to the plan assets. Why? Because, as discussed above, asset-based pricing and the use of investments to cover costs is easy and, at the end of the day, this model was simple to sell and because it stayed off the radar of sponsors and participants. The new disclosure rules, for the most part, turned the spotlight on total fees, while the next industry problem is really buried at the fund and participant level.

Thinking conceptually, why are service provider fees (recordkeeping, trustee, custodian, administration, investment advisory, audit, and even investment management) a percentage of plan assets? What internal costs actually increase for a service provider as assets increase? Whether a plan has $50 million versus $100 million doesn’t necessarily mean more work. Similarly, whether a participant’s balance is $20,000 versus $200,000 doesn’t necessarily create more work. A large portion of the cost is fixed and does not vary based solely on the increase in assets.

Granted, there is a risk element embedded in providing the services such that, if assets increase, risk increases, and the cost to protect against this risk increases too. However, this is only part of the internal cost of providing a service. The real question is: What internal cost elements of the provider vary with asset fluctuation, and what portion is that cost to the total cost of providing the services?

As consumers become more educated about these topics and as they start to ask the providers tougher questions, change will come. Because of revenue sharing disparity, there is some movement at the fund and participant levels towards normalizing fees that are currently skewed due to revenue sharing variations across a plan’s investment options. More sponsors and practitioners are beginning to discuss the question of fairness and evaluate how fees are paid at the participant level.

Ultimately, sponsors and providers in the industry need to take a hard look at why certain fees are asset-based as opposed to a more fixed arrangement, aligning the ongoing cost with the ongoing service. Asset-based fees are likely to survive; however, the added scrutiny will help keep fee levels in check as assets fluctuate, whether assets increase or decrease. This process is just beginning and change will continue to occur as more information is made available about this topic. As stated above, many sponsors aren’t even aware of the choice they have when it comes to assessing fees from their retirement plans. We hope this article provides some insight to help sponsors craft the best possible retirement program to meet the needs of their participants.